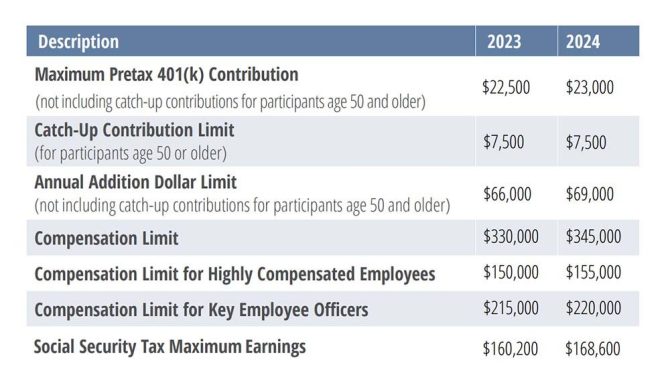

As they do each year, the IRS recently announced adjustments affecting the dollar limitations on 401(k) plans for tax year 2024. Since these changes impact everyone who currently sponsors (or is considering sponsoring) a 401(k) plan, we are sharing a chart reflecting the changes with all members, not just those who currently sponsor a NADA Retirement plan.

The contribution limit for employees who participate in their 401(k)-plan increased to $23,000, with the catch-up contribution limit remaining at $7,500 for employees age 50 and up. IRA contributions increased to $7,000, with a catch-up contribution limit of $1,000. For lower- and moderate-income employees, the income limit for the saver’s credit will increase to $76,500 for married couples filing jointly and $38,250 for singles.

As a business owner and plan sponsor, you may find that a few key changes could impact your personal situation:

- The Limitation for Defined Contribution Plans has been increased to $69,000.

- The maximum amount of earnings subject to the Social Security tax (taxable maximum) has been increased from $160,200 to $168,600.

Now is the time to plan any changes to your personal 401(k) contribution strategy for 2024 and to ensure that your payroll system will capture the new limits beginning in January.