California Will Eliminate the State Disability Wage Cap in 2024

Starting in 2024, the wage cap for California State Disability Insurance (SDI) payroll deductions will be eliminated.

Eliminating the wage cap will result in higher taxes and payroll deductions for individuals earning greater than $153,164 (the 2023 wage cap) per year.

Background

Starting in January 2024, as part of California Senate Bill 951 (SB 951), all wages earned will be subject to state disability payroll deductions. This new measure is intended to help pay for California state-mandated disability insurance, which will increase the average weekly wage replacement to between 63% and 90% (varying on an individual’s average weekly wage) starting on Jan. 1, 2025. To fund the increased benefit amount, the state is removing the wage cap on contributions to the state insurance disability fund effective Jan. 1, 2024.

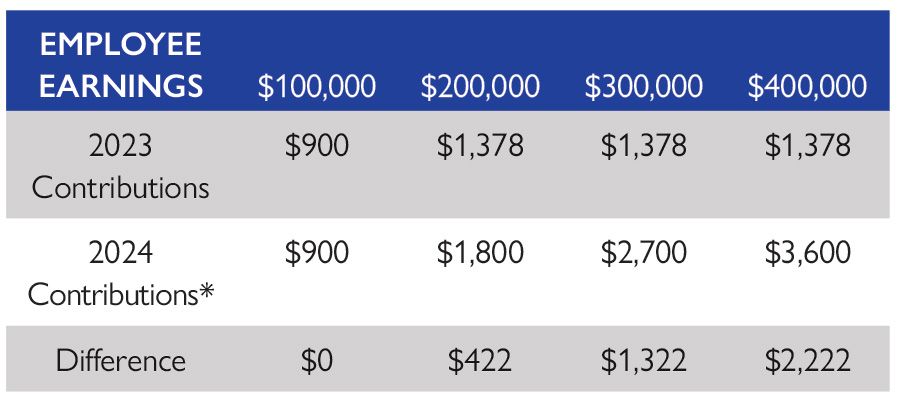

With the California SDI wage ceiling eliminated, high-earning employees ($153,164 for 2023) will face higher payroll taxes. To mitigate the increased tax impact, employers have the option to offer voluntary disability insurance (VDI) to replace state disability insurance. For certain employee populations, a VDI plan can be less expensive than the state plan allowing employers to pass on lower tax contribution rates and/or wage ceilings (subject to approval). Employees not impacted by SB 951 will also see the value of a lower contribution percentage, increased benefits and seamless administrative integration. The table below shows the payroll tax impact on individuals earning greater than $153,164 next year.

*Assuming the contribution percentage remains 0.9%

California State Disability Insurance

The California SDI program provides short-term Disability Insurance (DI) and Paid Family Leave (PFL) wage replacement benefits to eligible workers who need time off work. Employers with employees working in California may participate in the State plan or apply for approval to provide a voluntary plan to employees.

Employees may be eligible for SDI if they are unable to work due to a non-work-related illness or injury, pregnancy or childbirth. To be eligible, individuals must be employed or actively looking for work at the time the disability begins and have earned at least $300 from which disability insurance deductions were withheld during the base period.

Benefits for the state plan are funded through employee payroll deductions at a rate of 0.9% in 2023. The taxable wage limit in 2023 is $153,164 with a maximum annual withholding for an employee being $1,378.48. Starting in 2024, the taxable wage limit maximum cap for payroll deductions will be eliminated, meaning that all wages will be subject to the 2024 contribution rate with no annual maximum. The 2024 contribution rate has not been announced and may be less than, equal to, or greater than 0.9%.

Voluntary Disability Plans

Employers may offer a state-approved voluntary plan (VDI) to employees instead of State Disability Insurance. Voluntary programs must meet a specific set of requirements and be approved by the California Employment Development Department (EDD). VDI program requirements include:

- Written approval from the majority of employees eligible for coverage

- Cannot cost employees more than SDI

- Provide all the same benefits as SDI plus at least one that is better

- Allow employees to reject the VDI plan and choose SDI coverage

- Covered employees must be given a written document that outlines their benefits

- Must be offered to all eligible California employees of the employer. A separate program must be maintained for each FEIN with employees in California.

- Must be updated to match any increase in benefits that SDI implements because of legislation or approved regulation

The EDD will first grant conditional approval, pending submission of a security deposit based on the amount of the employer’s previous year’s taxable wages and the annual payroll deduction percentage (0.9% in 2023). Once an employer’s VDI is approved, they are no longer required to send State disability payroll deductions to the state, but rather the funds should be placed in a separate trust fund to pay their employees’ disability and paid family leave claims. An assessment paid to the state based on employees’ taxable wage amount is still required annually.

Next Steps for Employers

Work with your EPIC team to determine if a VDI plan is a good fit for your organization/employees:

- Do you have a highly-paid workforce that will be adversely affected by the removal of the wage cap on SDI contributions?

- Is your disability and PFL incidence rate low that would allow for a lower contribution rate or wage cap than SDI?

- Is your company prepared to assist in funding the VDI plan in the event employee contributions are not sufficient to pay claims and administrative costs, especially in the early years?

- Are you working with an STD claims administrator that can also manage a VDI plan or will you need to find a new or separate vendor?

- Is your benefits/financial team equipped to take on the additional administrative and financial reporting responsibilities required by the EDD?

- Does your company operate under a single FEIN within California? Employers with multiple FEINs must maintain separate plans for each FEIN including separate bonds and bank accounts.

If you would like more information on this change, EPIC will provide details to NCDA San Diego members.

EPIC ranks among the top 15 retail insurance brokers in the United States and is the largest insurer of auto dealers in the state. Alison McCallum has been in the employee benefits industry for over 20 years and personally works with more than 60 Southern California Dealerships. She is a Principal with EPIC Insurance Brokers and Consultants, the CNCDA’s only licensed employee benefits broker. With this partnership, EPIC offers unique dealership expertise and services available to NCDA San Diego dealer members at no cost. If you have questions or would like further information, please feel free to contact her at (949) 417-9136 or alison.mccallum@epicbrokers.com.